1031 Exchange

What is a 1031 exchange?

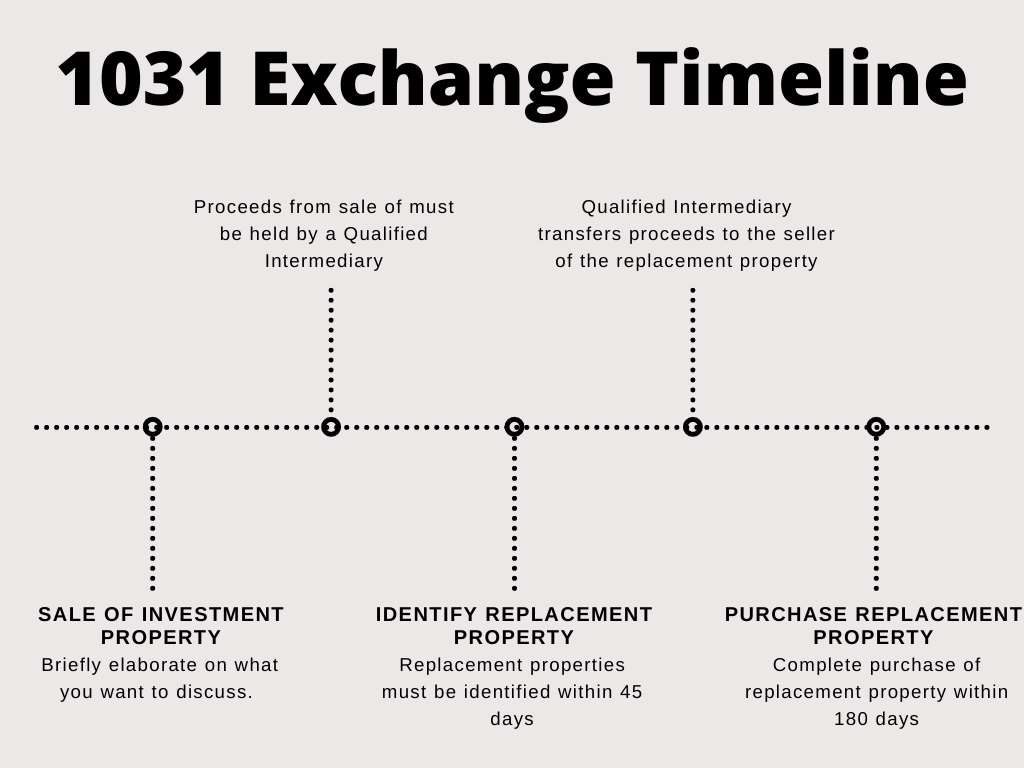

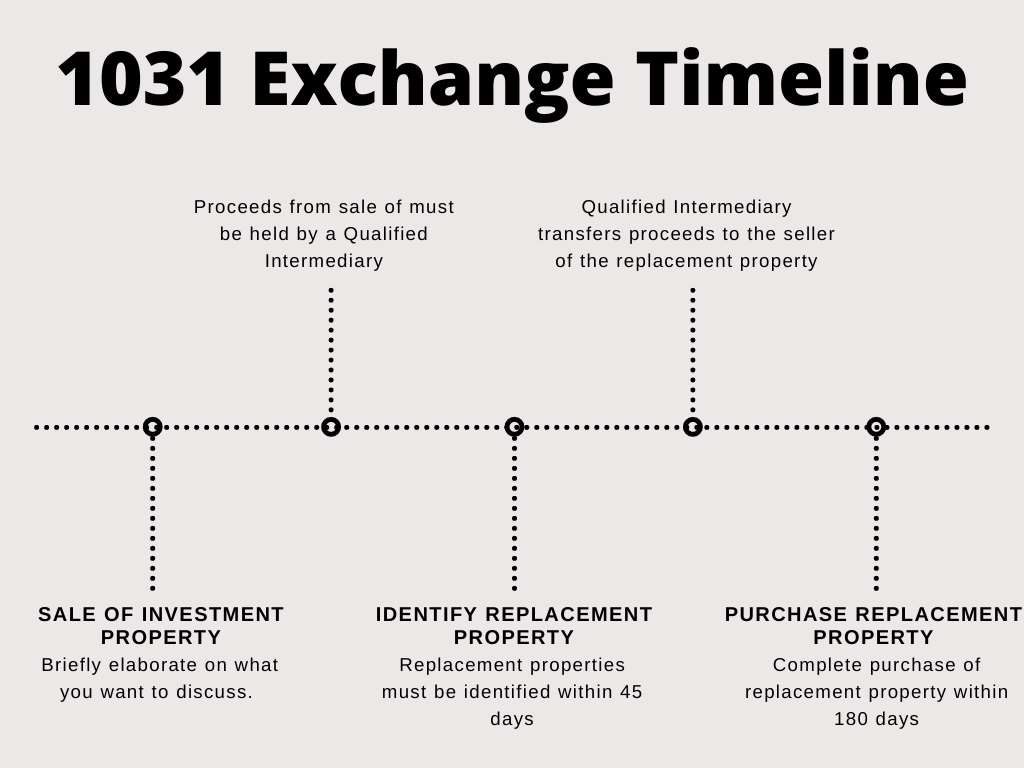

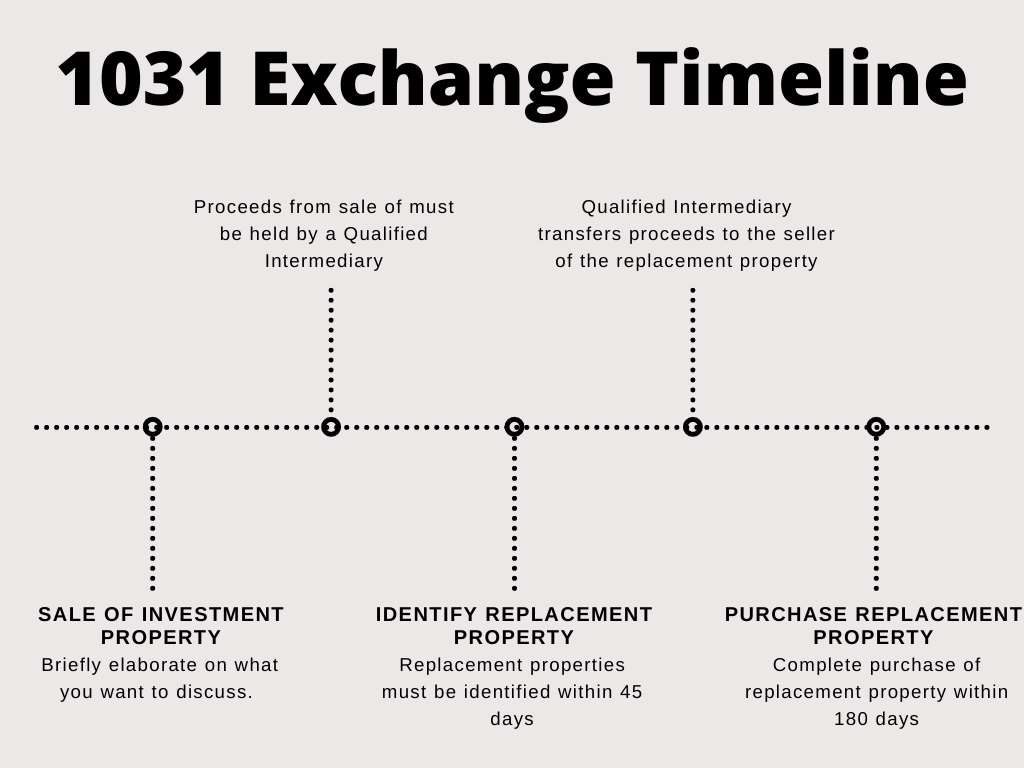

A 1031 exchange is an IRS-approved process that allows an investor to sell a property and reinvest all of the proceeds from the sale into a new investment property by deferring the payment of capital gain taxes.

Benefits of a 1031 exchange

- Keep more of your money working for you = Deferring capital gains taxes can provide greater compounding and more cash flow.

- Potentially defer paying capital gains taxes…forever = After a lifetime of deferring capital gains taxes, an investment property can be left to your heirs, who will inherit the property at a stepped up basis.

- Flexibility = 1031 exchanges allow you to exchange into different investment properties as your investment objectives evolve or as you seek to pursue different opportunities.

4 types of exchanges

- Delayed = Relinquished property is sold today and replacement property is purchased within 180 days after.

- Reverse = Replacement property purchased today and relinquished property sold within 18- days after.

- Improvement = All the requirements of a Delayed Exchange still apply, but a portion of the proceeds can go towards improvements to the new replacement property.

- Blended = A mix of both the Delayed and Reverse Exchanges. A property is sold today, a replacement property is purchased within 180 days, and then a 3rd property is sold after the replacement property is purchased.

Key points to remember

- Qualified Intermediary required = If the investor receives the money after the sale of the exchange property, taxes must be paid. The proceeds from the sale must go directly to a qualified intermediary.

- Same ownership structure must be maintained for the upleg and downleg of the exchange = If an LLC is the selling entity for a property, an LLC must be the owner of the replacement property.

- Replacement property must be the same price or higher in order to defer all capital gains taxes = If you exchange into a lower priced property, you will have to pay taxes on the difference

3 rules exist for identifying replacement properties

- 3-property rule = Identify up to three properties of any value with the intent of purchasing at least one.

- 95% rule = Identify more than three properties with an aggregate value exceeding 200% of the relinquished property, knowing that 95% of the market value of all properties identified must be acquired.

- 200% rule = Identify more than three properties with an aggregate value that does not exceed 200% of the market value of the relinquished property.

QUESTIONS?

To learn more about if a 1031 exchange is right for you, please contact us.